Despite challenging conditions, market activity in small- and mid-cap buyouts was strong throughout 2023, accounting for 56 per cent of all transactions. All in all, financial investors structured 34 management buyouts (MBOs) in 2023, a year-on-year decline of some 21 per cent, according to mid-market buyout statistics compiled by FINANCE magazine. Aggregate transaction volume amounted to 3.9 billion euros, compared to 4.1 billion euros in 2022. “A perfect storm of geopolitical tensions, soaring energy costs, supply bottlenecks and the turnaround in interest rates have had a major impact on the M&A market”, Tom Alzin, Spokesman of the Board of Management of Deutsche Beteiligungs AG, commented on overall market developments. Primary transactions – those which are not executed between financial investors – continue to account for the majority of deals, a trend that has been evident since 2004. Primaries accounted for 56 per cent of transactions in 2023, less than the year before (2022: 67.4 per cent), but still representing the majority. “DBAG succeeded in realising six disposals, most of which were agreed upon with strategic buyers. Thanks to our buy-and-build strategy, our portfolio companies have become especially relevant for strategic investors, resulting in more attractive valuations compared to those that can be achieved in transactions with financial investors”, Tom Alzin said, explaining DBAG’s strategy.

Strong focus on IT services and software

The sector focus is yet another striking aspect. With more than 26 per cent of transactions, the IT services and software sector is one of the focal industries in the mid-sized MBO market. DBAG’s portfolio shows a similar picture, where this sector – shaped by structural growth – accounts for 22 per cent of investments. AOE, a leading service provider for agile software development with a focus on customised business solutions, is DBAG’s seventh foray into this structural growth sector.

Slight increase in succession arrangements

Succession arrangements are one of DBAG's special areas of expertise, for which DBAG enjoys an excellent reputation thanks to its close ties to SMEs in the Germany, Austria and Switzerland (“DACH”) region and in Northern Italy. Reflecting this, of the eight succession transactions that took place in the SME MBO market in 2023 (compared to seven in 2022), DBAG accounted for half.

Financial investors structured 34 transactions in 2023, down from 43 in the previous year. Nonetheless, the total number of transactions in 2023 exceeds the average since records began (33).

This analysis only includes transactions in which financial investors acquired a majority stake alongside company management, and which had a transaction value for the financial debt-free company (enterprise value) of 50 to 250 million euros. This information was compiled from publicly available sources, together with estimates and research by DBAG in cooperation with the German trade magazine FINANCE.

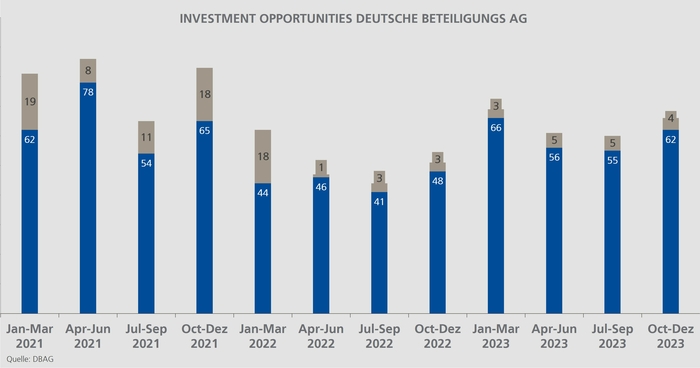

The market is offering attractive opportunities for new equity investments. During the first quarter of the 2023/2024 financial year, we have investigated 66 investment opportunities; this is a significantly higher number than the 51 we looked at in the first quarter of the previous year, and also more than the 60 opportunities examined in the last quarter of the previous financial year. This paves the way for further expansion of our investment portfolio.

Contact

Contact

Newsletter

Newsletter

Downloads

Downloads